As schools return in the North West, HM Revenue and Customs is reminding working parents they could save up to £2,000 per child per year to pay towards after-school clubs and other childcare services.

Around 170,000 families in the North West are eligible for Tax-Free Childcare, which can cut thousands of pounds off childcare bills.

All families have to do is pay into their Tax-Free Childcare account and for every £8 that they deposit, the UK Government immediately makes a top-up payment of an additional £2. The scheme is open to working parents, including the self-employed, who earn between the minimum wage and £100,000 per year and have children aged 0-11 years old. Families with a disabled child, aged 0-17 years old, can receive up to £4,000 in government support each year.

HMRC has also updated the Childcare Choices website so parents can now get personalised scheme information for each child.

Families can choose from childcare providers that have signed up to Tax-Free Childcare, including nannies, nurseries, childminders or after-school clubs.

HMRC’s Deputy Chief Executive and Second Permanent Secretary, Angela MacDonald, said:

“As more parents across the country return to work and kids head back to school following the outbreak of the Coronavirus pandemic, there has never been a better time to sign up to Tax-Free Childcare.

“It takes just minutes to set up an account on our improved and more accessible Childcare Choices website and soon you could be receiving up to £2,000 per child towards the cost of childcare each year.”

You can find out more and apply through the Childcare Choices website (www.childcarechoices.gov.uk). It includes a Childcare Calculator (www.gov.uk/childcare-calculator) that compares all the government’s childcare offers to check what works best for individual families.

- Working parents can apply, through the childcare service, to open an online childcare account. The scheme is available for children under the age of 12, or under the age of 17 for children with disabilities.

- If you or your partner have an ‘adjusted net income’ over £100,000 in the current tax year, you will not be eligible. This includes any bonuses you expect to get.

- For every £8 that families pay in, the UK Government will make a top-up payment of an additional £2, up to a maximum of £2,000 per child per year (or £4,000 for disabled children). This top-up is added instantly and parents can then send payments directly to their childcare providers. The maximum government top-up is £500 per quarter for each child, or £1,000 if the child is disabled.

- All registered childcare providers – whether nannies, nurseries, childminders or after-school clubs – can sign up online to receive parents’ payments through Tax-Free Childcare.

- Parents need to sign back in every three months and confirm their details are up-to-date, to keep getting government top-ups.

- You cannot get Tax-Free Childcare at the same time as claiming Working Tax Credit, Child Tax Credit, Universal Credit or childcare vouchers. To decide which scheme you’re better off with depends on your situation. Use the childcare calculator to work out which type of support is best for you.

- Families who were already signed up to Tax-Free Childcare but have fallen below the minimum income requirement due to COVID-19 will continue to receive financial support until 31 October. Critical workers who may exceed the income threshold for the 2020-21 tax year due to working more to tackle the pandemic, will continue to receive support this tax year. More information can be found here https://www.mynewsdesk.com/uk/hm-revenue-customs-hmrc/pressreleases/support-for-working-families-affected-by-coronavirus-given-an-extra-boost-3024707

- You can check your eligibility for Tax-Free Childcare or 30 Hours Free Childcare.

- Definition of critical workers affected by coronavirus: https://www.gov.uk/government/publications/coronavirus-covid-19-maintaining-educational-provision/guidance-for-schools-colleges-and-local-authorities-on-maintaining-educational-provision#critical-workers

POPULAR QUIZ NIGHT AT CHESTER MARKET RETURNS TO RAISE FUNDS FOR LORD MAYOR'S CHARITIES

POPULAR QUIZ NIGHT AT CHESTER MARKET RETURNS TO RAISE FUNDS FOR LORD MAYOR'S CHARITIES

Blues Match Report: Scarborough Athletic 1 - 0 Chester FC

Blues Match Report: Scarborough Athletic 1 - 0 Chester FC

Blues Match Preview: Scarborough Athletic v Chester FC

Blues Match Preview: Scarborough Athletic v Chester FC

The Cheshire Police and Crime Commissioner has saved ten PCSOs

The Cheshire Police and Crime Commissioner has saved ten PCSOs

Illegal vapes, tobacco and alcohol seized in trading standards operation

Illegal vapes, tobacco and alcohol seized in trading standards operation

Man charged in relation to burglary in Chester

Man charged in relation to burglary in Chester

Active travel and safety improvements coming to Ewloe roundabouts

Active travel and safety improvements coming to Ewloe roundabouts

Aquanatal Classes Make Waves at Local Swim School

Aquanatal Classes Make Waves at Local Swim School

CFC Women's Team Mid-Season Review

CFC Women's Team Mid-Season Review

Chester and Wirral Football League - Weekend Round Up

Chester and Wirral Football League - Weekend Round Up

Chester Zoo hits new all-time visitor record in landmark year for conservation charity

Chester Zoo hits new all-time visitor record in landmark year for conservation charity

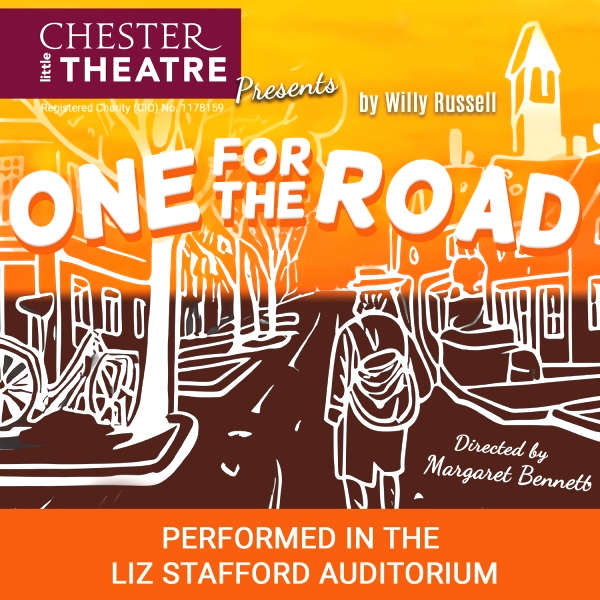

WILLY RUSSELL COMEDY SET TO BE STAGED AT CHESTER THEATRE

WILLY RUSSELL COMEDY SET TO BE STAGED AT CHESTER THEATRE

Blues Match Report: Chester FC 0 - 1 Worksop Town

Blues Match Report: Chester FC 0 - 1 Worksop Town

Blues Match Preview: Chester FC v Worksop Town

Blues Match Preview: Chester FC v Worksop Town

Countess of Chester Hospital urges public vigilance and handwashing to help stop the spread of Norovirus

Countess of Chester Hospital urges public vigilance and handwashing to help stop the spread of Norovirus

Cheshire Firefighter Recognised in New Year's Honours

Cheshire Firefighter Recognised in New Year's Honours