A local pension fund has become one of the first in the country to report on the carbon footprint of its £6 billion investment portfolio.

Cheshire Pension Fund has published its Climate Risk Report, which reveals that the carbon footprint of its equity investments is 30% below the general market, represented by the FTSE All World Index which covers more than 3,000 companies in 47 countries.

The Fund is the pension scheme for more than 100,000 members across 300 employers, including Cheshire West and Chester, Cheshire East, Halton and Warrington councils, Cheshire Police and Cheshire Fire and Rescue Service and a range of other employers in Cheshire. The Fund is administered by Cheshire West and Chester Council.

Cllr Myles Hogg, Chairman of the Cheshire Pension Fund, said: “The report confirms that the Cheshire Pension Fund has a good baseline from which to manage the risk presented to its investment portfolio from climate change.

"Our priority remains our financial duty to pay the pensions of our 100,000 members and to do this we need to ensure the assets of the fund are well diversified and resilient when faced with the impact of climate change.

“The Fund has previously invested more than £500 million in a pioneering Climate Change Factor Fund and the report confirms that this decision has helped reduce the carbon emissions from our investment portfolio.

"We understand that climate change is an important issue for our employers and members, so it is reassuring to see the difference this investment has already made to our carbon footprint.

The Fund will continue to explore what additional steps it can take to reduce investment risk through further reductions in its carbon footprint.”

The new report published by the Cheshire Pension Fund follows recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), a blueprint for climate reporting which represents best practice in the investment industry.

Its publication follows an independent and in-depth review of the climate risks of the Fund’s investment portfolio.

The report shows that the Fund has less exposure to companies with fossil fuel reserves and those exploiting coal reserves than the general market and reveals that it has more investment with companies who use clean technology than the general market.

The Fund invests in five different equity funds and all except one have a lower carbon footprint than the general market index. The one fund with a higher carbon footprint will now be reviewed to identify potential alternative investment funds.

The publication of the report will be followed by the publication of a climate strategy and climate stewardship plan.

For more information and to see the report visit: http://www.cheshirepensionfund.org/ and click on news.

Samantha Dixon MP Marks One Year Since Historic Election as First MP for Chester North and Neston

Samantha Dixon MP Marks One Year Since Historic Election as First MP for Chester North and Neston

Man convicted of raping a woman in Chester

Man convicted of raping a woman in Chester

Man jailed for drugs offences in Chester

Man jailed for drugs offences in Chester

Police appeal for help in tracing wanted Ellesmere Port man

Police appeal for help in tracing wanted Ellesmere Port man

Declan Weeks named Chester FC's Club Captain

Declan Weeks named Chester FC's Club Captain

Same-sex penguin couple hatch and raise chick at Chester Zoo

Same-sex penguin couple hatch and raise chick at Chester Zoo

Vines of Cheshire

Vines of Cheshire

Killer nurse Lucy Letby could face more charges

Killer nurse Lucy Letby could face more charges

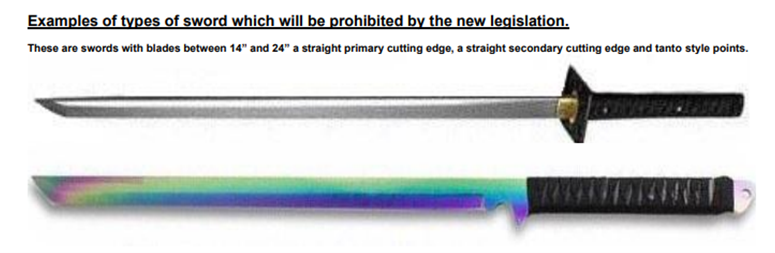

Ninja Sword amnesty launched ahead of legislation change

Ninja Sword amnesty launched ahead of legislation change

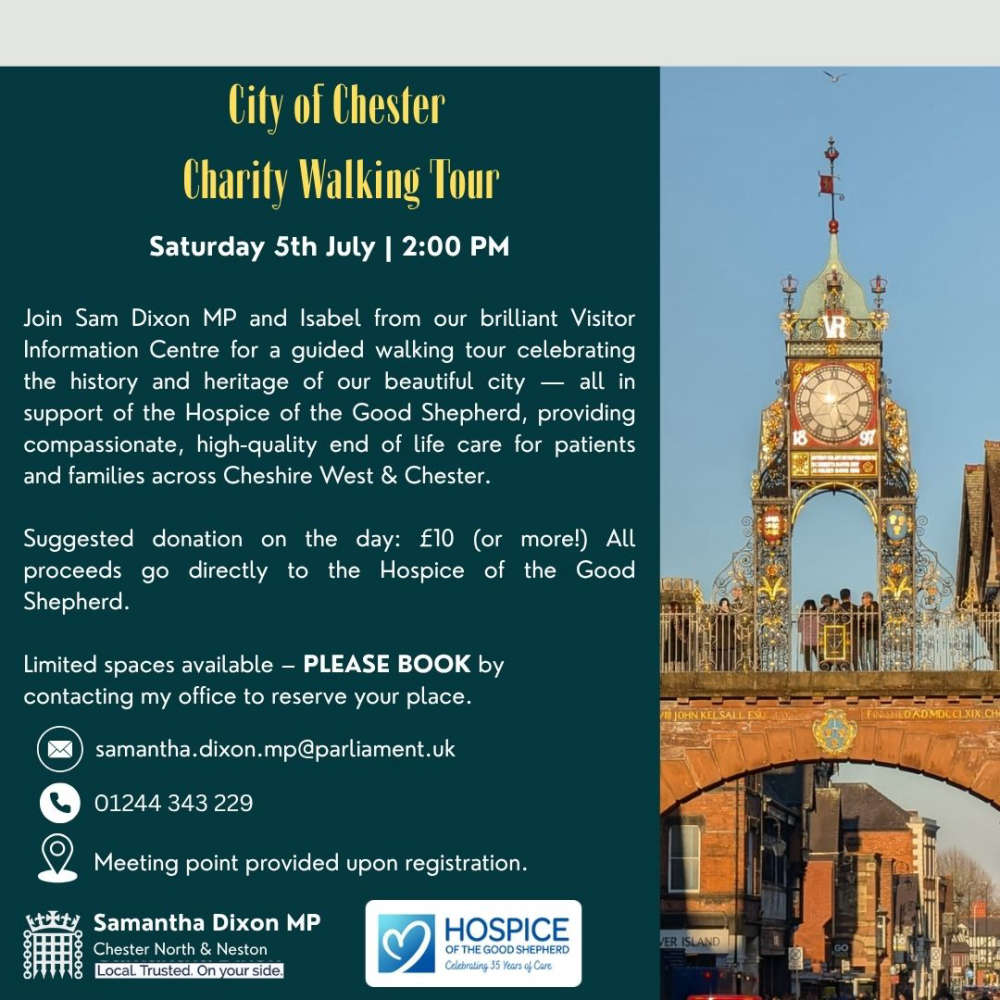

Charity Walking Tour in Support of the Hospice of the Good Shepherd

Charity Walking Tour in Support of the Hospice of the Good Shepherd

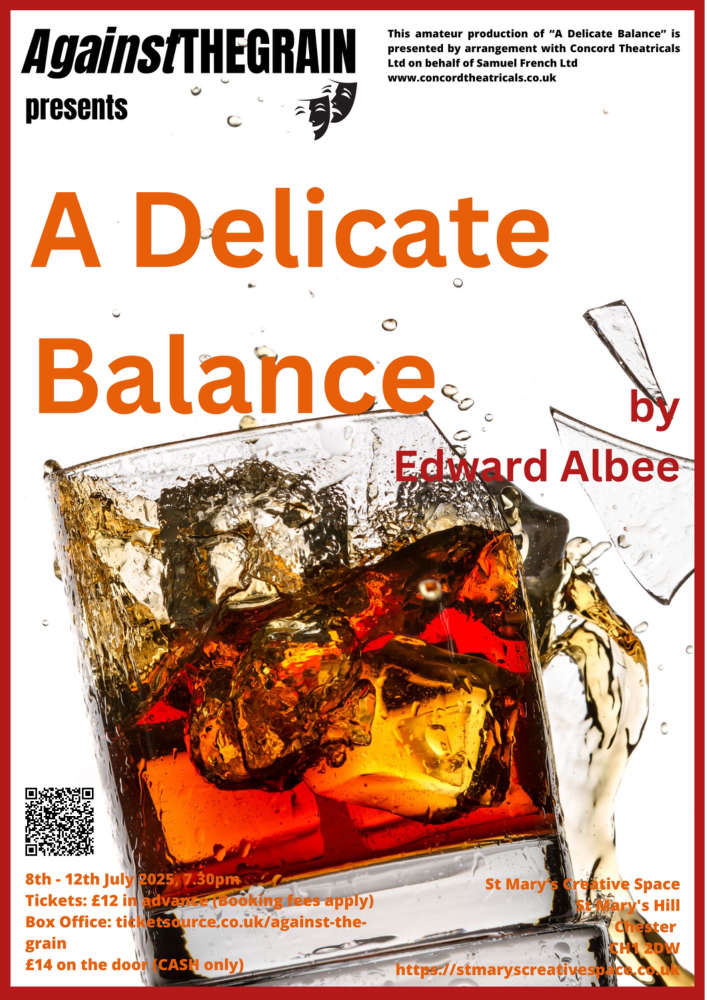

CURTAIN SET TO RISE ON BLACK COMEDY OF BAD MANNERS

CURTAIN SET TO RISE ON BLACK COMEDY OF BAD MANNERS

Three members of Lucy Letby hospital's senior leadership team arrested

Three members of Lucy Letby hospital's senior leadership team arrested

Man charged in relation to drugs offences in Chester

Man charged in relation to drugs offences in Chester

FROM ORPHAN TO VILLAIN, CARLY LANDS DREAM ROLE IN MUCH-LOVED MUSICAL

FROM ORPHAN TO VILLAIN, CARLY LANDS DREAM ROLE IN MUCH-LOVED MUSICAL

What's On At Jodrell Bank Over The Summer

What's On At Jodrell Bank Over The Summer

Teenager summonsed to court for driving offences in Tarporley

Teenager summonsed to court for driving offences in Tarporley

Fundraising duo from Flintshire and Essex to walk 350km in just 7 days for breast cancer charity

Fundraising duo from Flintshire and Essex to walk 350km in just 7 days for breast cancer charity

Citizens Advice Flintshire introduce a new drop-in service

Citizens Advice Flintshire introduce a new drop-in service

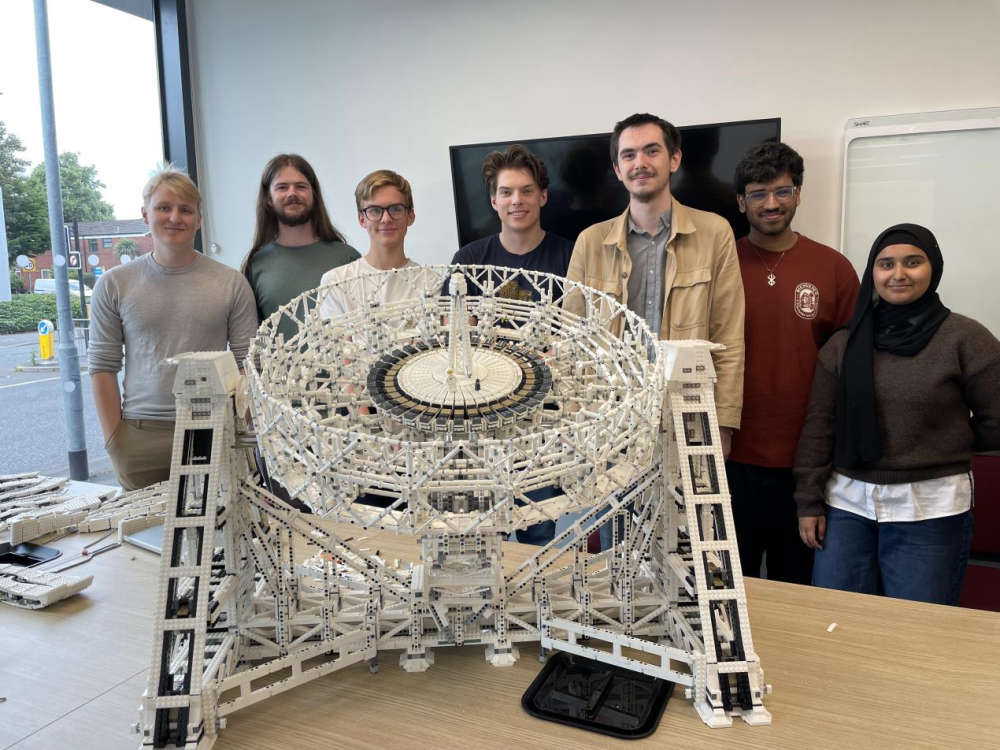

Students build Lego Lovell Telescope to celebrate cosmic legacy

Students build Lego Lovell Telescope to celebrate cosmic legacy

Man jailed following assaults in Chester

Man jailed following assaults in Chester