This week, HM Revenue and Customs will start contacting around three and a half million customers who may be eligible for the government’s Self-Employment Income Support Scheme to explain the application process and help them get ready to make a claim.

The claims service opens on Wednesday 13 May and is being delivered ahead of schedule, with payments reaching bank accounts by 25 May, or six working days after the claim is made.

The scheme will benefit self-employed individuals or those in a partnership whose business has been adversely affected by coronavirus, covering most people who get at least half of their income from self-employment. SEISS is a temporary scheme that will enable those eligible to claim a taxable grant worth 80% of their average trading profits up to a maximum of £7,500 (equivalent to three months’ profits) in a single instalment.

HMRC is using information that customers have provided in their 2018-19 tax return – and returns for 2016-17 and 2017-18 where needed – to determine their eligibility and is contacting customers who may be eligible via email, SMS or letter. We’re also opening an online checker from Monday 4 May which will let customers check their eligibility for themselves, as well as giving them a date on which they can apply.

Customers are eligible if their business has been adversely affected by coronavirus, they traded in 2019-20, intend to continue trading and they:

· Earn at least half of their income through self-employment;

· Have trading profits of no more than £50,000 per year; and

· Traded in the tax year 2018 to 2019 and submitted their Self Assessment tax return on or before 23 April 2020 for that year.

Where individuals are ineligible for the scheme, HMRC will direct them to guidance setting out the conditions to help them understand why they are ineligible, and advice about other support that might be available to them such as: income tax deferrals, rental support, Universal Credit, access to mortgage holidays and the various business support schemes the government has introduced to protect businesses during this time.

We expect our phone lines to be very busy over the next few weeks as people enter this new scheme, so are encouraging customers to only call us if they can’t find what they need on GOV.UK, from their tax agent or via our webchat service – this will leave the lines open for those who need our help most.

Ed Casson | Regional External Communications Officer - North West | HM Revenue & Customs | 03000 524697 | 07815 444469

Follow HMRC on Twitter at: @hmrcgovuk

Chester man found guilty of rape

Chester man found guilty of rape

Appeal for witnesses following graffiti on Chester walls

Appeal for witnesses following graffiti on Chester walls

Blues Match Report: Merthyr Town 1 - 2 Chester FC

Blues Match Report: Merthyr Town 1 - 2 Chester FC

Blues Match Preview: Merthyr Town v Chester FC

Blues Match Preview: Merthyr Town v Chester FC

Chester and Wirral Football League - Weekend Round Up

Chester and Wirral Football League - Weekend Round Up

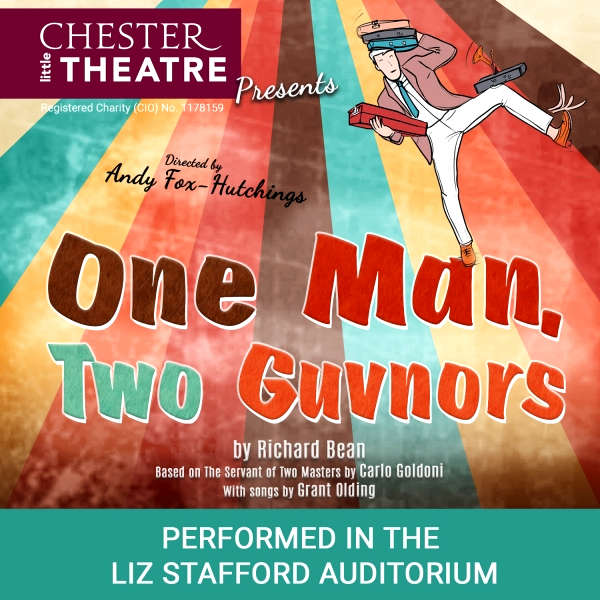

AWARD-WINNING COMEDY TO BE STAGED AT CHESTER LITTLE THEATRE

AWARD-WINNING COMEDY TO BE STAGED AT CHESTER LITTLE THEATRE

Cabinet to defer decision on schools’ reorganisation proposal

Cabinet to defer decision on schools’ reorganisation proposal

Local MP Justin Madders joins Gavin & Stacey star Alison Steadman to back Marie Curie appeal

Local MP Justin Madders joins Gavin & Stacey star Alison Steadman to back Marie Curie appeal

Make Your Food Go Further this Food Waste Action Week

Make Your Food Go Further this Food Waste Action Week

Council launches campaign to recruit more Shared Lives carers

Council launches campaign to recruit more Shared Lives carers

Men sentenced in connection with Cheshire West drug supply

Men sentenced in connection with Cheshire West drug supply

19TH CENTURY "GIRL POWER" SET TO BE CELEBRATED AT CHESTER CONCERT

19TH CENTURY "GIRL POWER" SET TO BE CELEBRATED AT CHESTER CONCERT

Blues Match Report: Chester 2 - 1 Darlington

Blues Match Report: Chester 2 - 1 Darlington

Blues Match Preview: Chester FC v Darlington

Blues Match Preview: Chester FC v Darlington

Councillors urged to throw out proposals to merge four catholic schools

Councillors urged to throw out proposals to merge four catholic schools

Man jailed following Ellesmere Port phone robbery

Man jailed following Ellesmere Port phone robbery

Charlie’s 20‑mile challenge brings joy to young patients at the Countess of Chester Hospital

Charlie’s 20‑mile challenge brings joy to young patients at the Countess of Chester Hospital