From 22nd January 2024, the DWP (Department for Work and Pensions) and HMRC will be issuing Universal Credit migration notices to Flintshire residents currently in receipt of Tax Credits.

Each Tax Credit recipient will have 3 months from the date of their letter and must claim Universal Credit or lose the benefit, as it’s being phased out.

Because of the transitional element, Tax Credits claimants should WAIT until they receive their official HMRC/DWP ‘Managed Migration Notice’ letter before claiming Universal Credit or they may lose money. If unsure, they should seek advice.

Citizens Advice Flintshire are dealing with an influx of enquiries about the migration process and are encouraging those receiving letters to establish which benefits they might be entitled to by contacting ‘Claim What’s Yours’ on:

0808 250 5700

Those needing help to apply for Universal Credit, or advice about the initial managed migration process, should contact the ‘Help to Claim’ helpline on:

08000 241 220

Tax Credit claimants seeking more information about the Universal Credit Managed Migration process can find it here:

https://www.gov.uk/guidance/tax-credits-and-some-benefits-are-ending-move-to-universal-credit

Here are the key points of this UC migration:

-

Tax Credit claimants who currently receive ‘Child Tax Credit’ and/or ‘Working Tax Credit’ PLUS other ‘legacy’ benefits: Housing Benefit; Income-Related Employment and Support Allowance (ESA); Income-Based Job Seeker’s Allowance (JSA) or Income Support will NOT be asked to migrate over to Universal Credit in Flintshire just yet. Claimants who also receive legacy benefits will start to receive managed migration notice letters from April 2024.

-

If Tax Credits claimants have received a Universal Credit Managed Migration notice letter, this migration process does not happen automatically and if a claimant does not make a Universal Credit claim before the 3 month deadline printed on their letter - their Tax Credits claim will end (even if they have not made a claim for Universal Credit) and they cannot make a new claim for Tax Credits. Claimants who miss their migration deadline should seek advice straight away.

-

Tax Credit claimants providing ‘good reasons’ for needing to delay their managed migration claim, can have the deadline extended in some circumstances, and should contact the Universal Credit Managed Migration helpline on: 0800 169 0328 or seek advice if they need support with this.

-

Tax Credits claimants should not be financially ‘worse off’ by migrating onto Universal Credit and a Universal Credit claim made during their managed migration period will receive an extra ‘transitional element’ to make up any financial difference (compared to what they were receiving under Tax Credits). Claimants financially worse off after claiming Universal Credit should seek advice straight away.

-

There may be some instances where a Tax Credit claimant needs to seek advice about when to ‘time’ their Universal Credit claim - within their 3 month deadline period. This may be due to a change of circumstances in the household or to help them budget until they receive their first Universal Credit payment.

-

Tax Credit claimants successfully applying for Universal Credit during a tax year will still need to finalise their Tax Credits claim - in the same way they normally did at the end of the tax year.

-

Tax Credits claimants who have over £16,000 in capital (such as savings, bonds/ISAs or property ownership - other than the house they live in) can still apply for Universal Credit and this capital will be disregarded for 12 months.

-

Under normal circumstances, some full-time students are not eligible for Universal Credit. However, there is some protection for current full-time students receiving Tax Credits under managed migration - which means they will be entitled to Universal Credit for the duration of their existing course.

-

If claimants are self-employed, their responsibilities under Universal Credit will change (compared to Tax Credits). However, they will not be subject to Universal Credit 'minimum income floor’ earnings rules for the first 12 months of their Universal Credit claim.

Council uses powers to close shops selling illegal vapes and tobacco products

Council uses powers to close shops selling illegal vapes and tobacco products

Public consultation on the future of public toilets at Holywell, Mold and Talacre

Public consultation on the future of public toilets at Holywell, Mold and Talacre

Man jailed for 16 years after being found guilty of rape

Man jailed for 16 years after being found guilty of rape

Ellesmere Port community projects awarded share of Police and Crime Commissioner’s £150k fund

Ellesmere Port community projects awarded share of Police and Crime Commissioner’s £150k fund

Chester community projects awarded share of Police and Crime Commissioner’s £150k fund

Chester community projects awarded share of Police and Crime Commissioner’s £150k fund

Council completes chewing gum cleaning project

Council completes chewing gum cleaning project

Chester Market celebrates three years of success

Chester Market celebrates three years of success

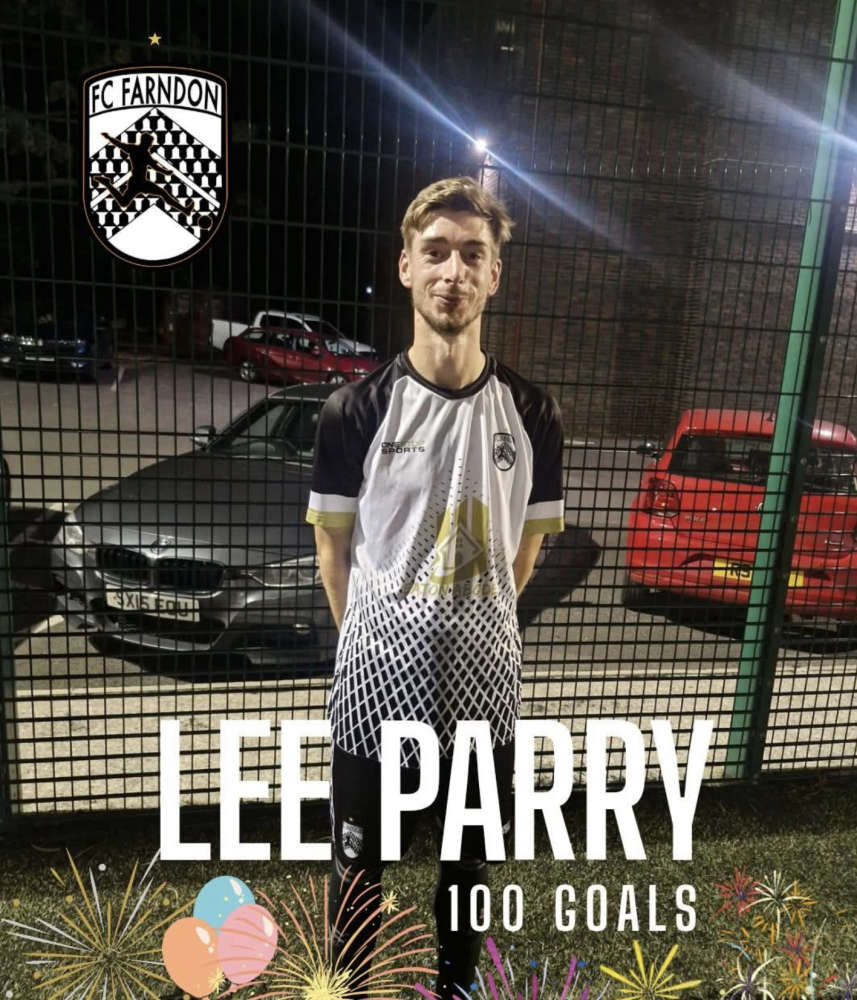

Chester and Wirral Football League - Latest Results

Chester and Wirral Football League - Latest Results

Blues Match Report: Chester FC 1 - 1 Marine

Blues Match Report: Chester FC 1 - 1 Marine

Wanted man from Ellesmere Port arrested and charged

Wanted man from Ellesmere Port arrested and charged

'Winter Warmer' initiative for local over 60’s in North Wales

'Winter Warmer' initiative for local over 60’s in North Wales

Inaugural meeting of the Cheshire and Warrington Combined Authority Shadow Board

Inaugural meeting of the Cheshire and Warrington Combined Authority Shadow Board

Cheetah brothers arrive at Chester Zoo

Cheetah brothers arrive at Chester Zoo

Ex-Chester FC star helps create stunning poppy tribute

Ex-Chester FC star helps create stunning poppy tribute

FREE CHESTER CONCERT SET TO CELEBRATE WORK OF RENOWNED NORTH WEST BASED COMPOSER

FREE CHESTER CONCERT SET TO CELEBRATE WORK OF RENOWNED NORTH WEST BASED COMPOSER

MUSIC BY RENOWNED WELSH FEMALE COMPOSER TO FEATURE IN WREXHAM ORCHESTRA REMEMBRANCE CONCERT

MUSIC BY RENOWNED WELSH FEMALE COMPOSER TO FEATURE IN WREXHAM ORCHESTRA REMEMBRANCE CONCERT

Blues Match Report: Cambridge United 3 - 0 Chester FC

Blues Match Report: Cambridge United 3 - 0 Chester FC

Blues Match Preview: Cambridge United v Chester FC

Blues Match Preview: Cambridge United v Chester FC

Cheshire Constabulary welcomes its newest four-legged crime fighter ahead of her Police Dog training

Cheshire Constabulary welcomes its newest four-legged crime fighter ahead of her Police Dog training

Appeal to trace wanted man from Ellesmere Port

Appeal to trace wanted man from Ellesmere Port

Comments

Add a comment