Cheshire West and Chester Council, one of nearly 50 UK Fair Tax Councils, is proud to be part of Fair Tax Week 2023, which runs from 8-18 June.

Cheshire West and Chester Council is part of a growing movement of cities, towns and districts standing up for responsible tax conduct

The number of Fair Tax Councils more than doubled last year and continues to grow.

Cllr Carol Gahan, Cabinet Member for Finance and Legal, said: “We’re proud to be backing fair tax in our local area. It’s great to have Fair Tax Week as a way to draw attention to the need for honesty and transparency when it comes to tax, for the benefit of everyone.

“By signing up to this initiative we are seeking to lead by example. As we rebuild after the Coronavirus pandemic – and the challenge this presents to crucial frontline services – everyone needs to pay their fair share. During Fair Tax Week we’re joining in to celebrate the organisations that are proud to pay the right amount of tax for the benefit of all, and to champion the positive role that tax plays in our society.”

Mary Patel, Networks Manager at the Fair Tax Foundation, said: “Tax is so important when considered against the huge array of public services it helps support. Fair Tax Week is the perfect opportunity to celebrate councils like Cheshire West and Chester Council who are proud to stand up for responsible tax conduct.

“Recent research has found that the UK loses an estimated £17bn in corporation tax revenues as a result of profit shifting alone. Backing fair tax and transparent financial reporting should be clear common ground for all parties as we seek to rebuild, level up and drive out dirty money.”

Significantly, recent polling has found that two thirds of people (66%) believe the Government and local councils should consider a company’s ethics and how they pay their tax, as well as value for money and quality of service provided, when awarding contracts to companies.*

About the Fair Tax Foundation

The Fair Tax Foundation was launched in 2014 and operates as a not-for-profit social enterprise. The Fair Tax Foundation believes that companies paying tax responsibly should be recognised and celebrated; and any global race to the bottom on tax competition should be resisted. UK Fair Tax Councils have signed up to the Councils for Fair Tax Declaration or otherwise shown significant support for fair tax. The UK Councils for Fair Tax Declaration commits councils to:

- leading by example on their own tax conduct

- demanding to know who owns and profits from businesses the council buys from – UK and overseas – and their full financial reports

- joining calls for UK public procurement rules to change so that councils can do more to tackle tax avoidance and award points to suppliers that demonstrate responsible tax conduct.

The Fair Tax Mark business accreditation scheme is the gold standard of responsible tax conduct. It seeks to encourage and recognise organisations that pay the right amount of corporation tax at the right time and in the right place.

Data on the scale and impact of global tax avoidance is derived from the “Missing Profits” initiative, as provided by researchers from the University of California, Berkeley and the University of Copenhagen. See

AN UPDATE FROM CFU VICE-CHAIR JIM GREEN

AN UPDATE FROM CFU VICE-CHAIR JIM GREEN

CHESTER FC TO VISIT MACCLESFIELD IN PRE-SEASON

CHESTER FC TO VISIT MACCLESFIELD IN PRE-SEASON

Plan ahead for overnight closures on M56 near Manchester Airport

Plan ahead for overnight closures on M56 near Manchester Airport

Almost two million older people are living in poverty in the UK

Almost two million older people are living in poverty in the UK

GOLF PROJECT IS BIG HIT WITH PETTY POOL LEARNERS

GOLF PROJECT IS BIG HIT WITH PETTY POOL LEARNERS

Countess of Chester Hospital consultant running Chester Half Marathon after shedding almost ten stone

Countess of Chester Hospital consultant running Chester Half Marathon after shedding almost ten stone

Spotlight shines on Cheshire West

Spotlight shines on Cheshire West

IMMERSIVE LINE-UP OF ENTERTAINMENT ANNOUNCED FOR ROMAN DAY AT CHESTER RACECOURSE

IMMERSIVE LINE-UP OF ENTERTAINMENT ANNOUNCED FOR ROMAN DAY AT CHESTER RACECOURSE

International team of conservationists hand-rear blue-eyed ground-dove chick

International team of conservationists hand-rear blue-eyed ground-dove chick

Foster Wales Flintshire is calling on people to consider becoming foster carers

Foster Wales Flintshire is calling on people to consider becoming foster carers

Air quality improvements could see end of air quality management areas in Ellesmere Port and Frodsham

Air quality improvements could see end of air quality management areas in Ellesmere Port and Frodsham

Protecting people from the sun

Protecting people from the sun

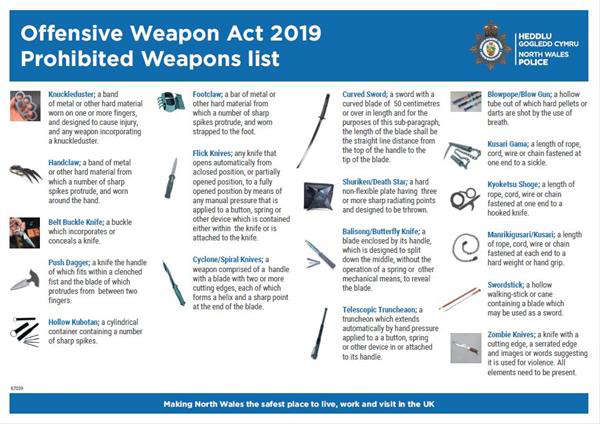

Come and speak to North Wales Police

Come and speak to North Wales Police

Supporting people on their journey to employment

Supporting people on their journey to employment

Ian Puleston-Davies opens new staff wellbeing hub at Countess of Chester Hospital NHS Foundation Trust

Ian Puleston-Davies opens new staff wellbeing hub at Countess of Chester Hospital NHS Foundation Trust

One week to the Council’s event to help you switch to electric vehicles

One week to the Council’s event to help you switch to electric vehicles

Rural Crime Team equipped with mobile defibrillators

Rural Crime Team equipped with mobile defibrillators

Comments

Add a comment