The COVID-19 Additional Relief Fund (CARF) supports businesses that have been affected by the pandemic, that are ineligible for existing support linked to Business Rates.

Cheshire West and Chester Council has a further £7,703,055 from the Government to support local businesses.

Where a Business has been adversely affected by the pandemic and unable to adequately adapt to that impact the Council will award relief of 100 per cent of their 2021/22 business rate liability up to a rateable value of £15,000. Where a business has a rateable value of over £15,000 the council will award up to an additional 5 per cent. The total amount of relief that will be awarded to a business is capped at 2 per cent of the government funding including those that have multiple assessments.

Businesses will be required to evidence the impact of COVID and sign a declaration to confirm that they do not exceed subsidy levels

To be eligible:

- The Business must have been adversely affected by Covid-19 and suffered a trading loss.

- The business must have been in occupation of their premises and trading or providing a service during the period 1 April 2020 to 31 March 2022

- Businesses must be liable to pay Business Rates between the period 1 April 2020 to 31 March 2022

All awards will be by a credit against the business rates account, it is not expected that any cash payments will be made.

Applications will be open from 18 March 2022, until 17 April 2022 using the form at: www.cheshirewestandchester.gov.uk/grant.

The Council aims to contact businesses with a decision within 20 working days of an application being received. If an application is successful, rate relief will be applied, and a revised bill issued.

Councillor Carol Gahan Cabinet Member for Legal and Finance said: “The Council has been supporting businesses with government grant payments throughout the pandemic.

“I’d urge any business that have been affected and are eligible for the additional relief funding to submit an application.”

The Council is responsible for designing discretionary relief schemes operating within the borough. However, in line with government guidelines the Council:

- must not award relief to ratepayers who for the same period of the relief (1 April 2021 to 31 March 2022) either are or would have been eligible for the Extended Retail Discount (covering Retail, Hospitality and Leisure), the Nursery Discount or the Airport and Ground Operations Support Scheme (AGOSS),

- must not award relief to a hereditament for a period when it is unoccupied (other than hereditaments which have become unoccupied temporarily due to the government’s advice on COVID-19), and

- should direct their support toward ratepayers who have been adversely affected by the pandemic and have been unable to adequately adapt to that impact.

- may not grant the discount to itself or to a precepting authority (eg Town Council, Parish), in line with the legal restrictions in section 47(8A) of the Local Government Finance Act 1988.

The Council has also decided to exclude the following businesses

- Advertising Rights/Boards & Land used for Advertising

- Communication Infrastructure

- Car parking spaces and private car parks

- Land used for storage

- Utilities (Pipeline & appurtenances)

- Banks/ATM

- Schools & Universities

- Vets/legal services/professional services (financial services etc)

- Businesses who can claim back any business rates paid (for example: from the government, or from a landlord if the tenancy agreement specifies that rent is inclusive of rates).

Businesses receiving 100% Small Business Rates Relief (SBRR) will not be eligible for support under the CARF scheme. Businesses receiving partial SBRR (those with a rateable value of between £12,001 and £15,000) will be eligible for support in respect of the liability for Business Rates not covered by SBRR

To maximise the use of the limited funding the total relief awarded from CARF to an organisation will not exceed 2 per cent of the grant allocated to Cheshire West and Chester Council, including those with multiple assessments.

The fund replaces the right for a business to request a reduction in business rates from the Valuation Office Agency. This is on the grounds that COVID-19 has been a material change in circumstances which makes the rateable value of the property inaccurate. Cheshire West and Chester Council has access to limited funds from the government for this fund which has replaced the legal right to appeal to the Valuation Office Agency on Material Change of Circumstances grounds due to COVID.

In devising its policy Cheshire West and Chester Council has been mindful if the government’s guidelines which can be found here

Cheshire West and Chester Council secures funding to decarbonise council housing

Cheshire West and Chester Council secures funding to decarbonise council housing

Protecting people from the sun

Protecting people from the sun

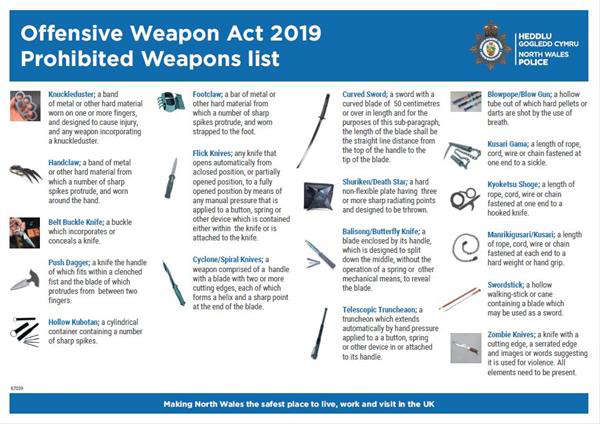

Come and speak to North Wales Police

Come and speak to North Wales Police

Supporting people on their journey to employment

Supporting people on their journey to employment

Ian Puleston-Davies opens new staff wellbeing hub at Countess of Chester Hospital NHS Foundation Trust

Ian Puleston-Davies opens new staff wellbeing hub at Countess of Chester Hospital NHS Foundation Trust

One week to the Council’s event to help you switch to electric vehicles

One week to the Council’s event to help you switch to electric vehicles

Rural Crime Team equipped with mobile defibrillators

Rural Crime Team equipped with mobile defibrillators

New online hub for the Dee Estuary

New online hub for the Dee Estuary

Chester and Wirral Football League - Latest Results

Chester and Wirral Football League - Latest Results

Is being a wholetime firefighter the job for you?

Is being a wholetime firefighter the job for you?

RISING YOUNG MUSICAL THEATRE STAR SET TO JOIN CHESTER CHOIR AS SPECIAL GUEST

RISING YOUNG MUSICAL THEATRE STAR SET TO JOIN CHESTER CHOIR AS SPECIAL GUEST

CHESHIRE WOMEN’S CRICKET LEAGUE - LATEST RESULTS

CHESHIRE WOMEN’S CRICKET LEAGUE - LATEST RESULTS

Local MP has pledged support for those suffering with endometriosis

Local MP has pledged support for those suffering with endometriosis

Make History: Build a Future Free From Homelessness

Make History: Build a Future Free From Homelessness

Cheshire Constabulary to support national operation to cut out county-wide knife crime

Cheshire Constabulary to support national operation to cut out county-wide knife crime

Comments

Add a comment